CEO interview: AMS’ Laney on driving a sensor-driven business

Kirk Laney was at Texas Instruments for 19 years up to 1998 when he helped organize a management buy out of the optoelectronics division he was leading there. That became Texas Advanced Optoelectronic Solutions Inc. (TAOS) a company that Laney built up for 13 years before its acquisition by AMS

"At TAOS we saw an integrated sensor opportunity in areas like ambient light sensing and proximity sensing and benefited in the smartphone space. Then there was the 2011 acquisition by AMS and I came along with the deal. And in 2013 John Heugle stepped down as CEO and I was asked to take over his position."

Laney makes the point that it had not been his intention to eventually lead the company when AMS acquired TAOS and that the deal did not represent some kind of reverse takeover. Nonetheless TAOS, which had been a foundry customer of AMS, added significant sales to AMS and under Laney the vision has become to make AMS into a sensor solutions company. "We want to leverage our competence in analog semiconductor manufacturing and design. We have 400 analog design engineers."

Kirk Laney, CEO of AMS.

AMS is active in magnetic, optical sensing, sensor interfaces, power management ICs for things like motor control and short-range wireless communications but with 75 to 80 percent of sales in the sensor and sensor interface category, said Laney. "The Applied Sensor acquisition [developer of chemical sensors] complements our portfolio nicely. We continue to be opportunistic in terms of looking for companies to acquire."

AMS is generally oriented towards serving industrial, medical and automotive sectors with some sales into white-goods consumer and ambient light sensing in smartphones and tablet computers.

Re-org

Under Laney AMS has re-organized its business divisions. What was organized by end-market sector; automotive, industrial & medical, consumer, communications has been regrouped around sensor competencies, Laney said. This is an interesting reversal of the conventional wisdom of the 1980s and 1990s, which said companies should be end-user sector focused to help ensure that they were driven by customer demand rather than technology-push.

The advance optical sensors division services LED-oriented business and is mainly about display management but is looking to grow with sensing and controlling.

Entrance to Schloss Premstaetten, which contains AMS offices.

The sensors and sensor interface division is more general and less consumer oriented. It is selling multiple technologies into industrial, medical and automotive applications including components for LIDAR – light detection and ranging – and computer tomography.

The emerging sensor technology business includes power and wireless management but is also looking to sensor-driven lighting. Laney is clear that the success achieved by TAOS in tuning the LED-driven displays of smartphones and tablet computers can be repeated by AMS around LED lighting with automatic color and dimming control becoming the norm for reasons of power efficiency and people’s medical well-being. The same division is also looking at narrow-band spectral sensing and multichannel narrowband spectral sensing for lab-on-a-chip medical and food processing applications.

Laney said he is excited about the opportunities. They are vast and largely untapped whether it is for authentication of coffee products or artwork, for measuring gases and chemicals in heating, ventilation and air conditioning systems or monitoring the quality of milk in China.

The emerging technology division also demonstrates something of Laney’s painstaking and methodical approach to business and his desire to replicate the success of TAOS. In essence Laney believe the keys to success lie in the detail and getting those details right for the customer.

"There’s a fine line between tracking the market and bringing out a disruptive part. At TAOS we created the market for display management. We thought it was going to be in laptop computers but, in fact, it went quickly with the introduction of smartphones. Now we are looking to add gesture recognition, proximity detection. We have to continually re-invent ourselves."

One thing that Laney is not interested in is moving AMS towards sensors that have become commoditized. "When we started TAOS we realized that CMOS image sensors was going to become a blood bath. We didn’t want to go there. The same is true of inertial MEMS – that is unless we can combine inertial MEMS sensors with something else and create value at a higher level."

In other words Laney wants the emerging sensor division to find the point where a novel sensor technology meets a business need and AMS can get all the details right for a customer and essentially create a whole new market, whether that is in the LED light bulb, in the HVAC thermostat, in the automotive cockpit or on the outside surface of the car, or in a medical, veterinary or dentistry application.

Manufacturing expansion

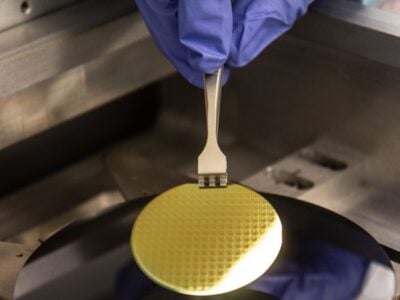

AMS’ fourth business unit is foundry, Laney said. "We keep foundry for differentiation in high-precision solutions and outsource the digital to TSMC," said Laney. "We have a manufacturing capacity of 160,000 wafers per year. We are looking for additional foundry capacity."

Entrance to the modern AMS offices and wafer fab complex. But it looks like Laney will be taking AMS into Asia to add to manufacturing capacity.

Laney explained that AMS is shopping for a 200mm wafer fab that is coming to the end of its life as a source of digital chips and that AMS can re-invigorate by using it for analog, MEMS and sensor production and possibly for 3D circuit production.

"There are a lot of considerations when exploring these opportunities. It is about finding the right sort of relationship because this will be a transition process. The fab must have some product running that we are prepared to take over and then we can phase our products in at 180nm."

Laney said that he was 95 percent certain AMS’ fab acquisition would not be in Europe. "We’re look for a dollar-based fab. Asia could be a preferred location," Laney said.

IoT and wearables

In terms of AMS digital capability the company offers ARM- and 8051-based microcontrollers. "Where sensor solutions need to be small we can produce a system solution. That’s why wearables and the Internet of Things is an interesting space for us. I don’t like the name Internet of Things but I think it is a reality.

"Imagine humidity sensors buried in sheetrock [plasterboard]. If they are triggered they can send a message to cut off the main water supply potentially saving thousands of dollars in damage repairs. And the information can be uploaded to the Internet to send a message to a cell phone. That’s just one of thousands of examples. The IoT is going to link sensors around the world.

And AMS manufacturing can help make tiny autonomous wireless sensor nodes by performing 3D assembly of die, said Laney. "One of the reasons I felt it was very competitive to put TAOS with AMS was its ability with through-silicon vias (TSVs)," Laney said. "TSV is very important with optical chips because flip chipping is often not an option, because usually optical sensors have to look up. The ability to offer reliable solutions for optical systems is often about stacking die. Foundries offering TSV have an advantage."

That Dialog miss

However, AMS was nearly integrated out of existence through a merger with Dialog Semiconductor plc. It appears the company’s have agreed not to merge but does that mean AMS is now "in-play" and at risk of being consolidated rather than being a consolidator?

"We know the guys at Dialog pretty well. We both sell PMICs but we don’t compete that much. It would have created a powerful number-four chip company in Europe but it’s hard to layer one structure on top of another. The customer concentration didn’t bother us but the margins and revenues are different."

"The market view is that the parting of the ways has been favorable for AMS. Dialog would have been a challenge in terms of integration."

As to whether AMS is "in-play" Laney doesn’t see specific danger of that happening despite the spate of mergers and acquisitions going on throughout the electronics and semiconductor industries. "Mergers don’t take place unless there’s good alignment," he said. "We’re leveraging great analog design capability to create high value sensor solutions. I think sensor-driven lighting, spectral sensing, automotive, wearable and medical are going to be great for us."

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News

If you enjoyed this article, you will like the following ones: don't miss them by subscribing to :

eeNews on Google News